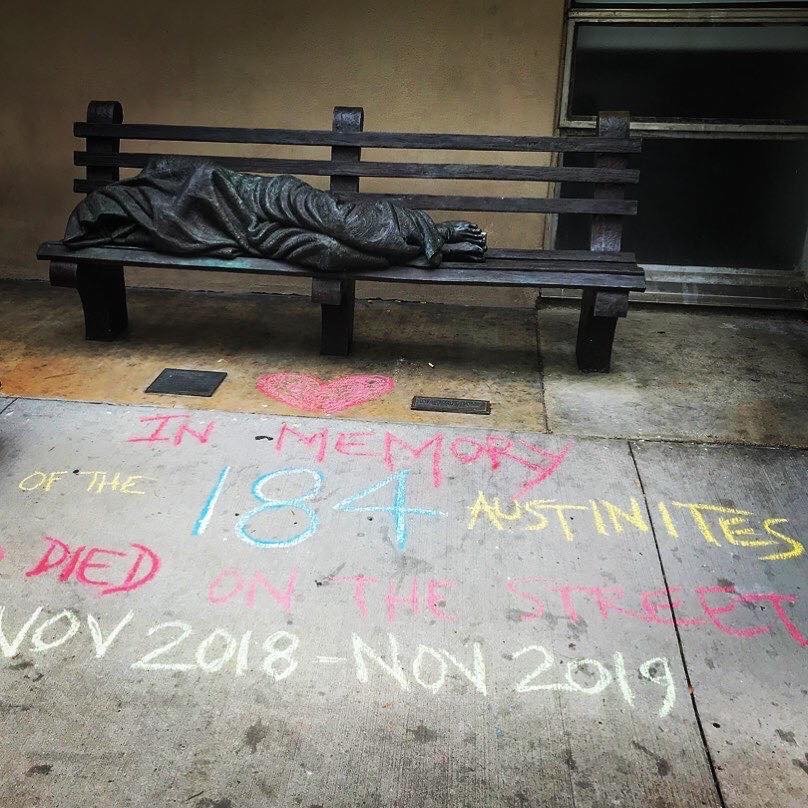

Homeless – Day of Remembrance

Austin American Statesman from 11/01/2019 early morning service – prayers for homelessness and a better way. https://www.statesman.com/photogallery/TX/20191101/PHOTOGALLERY/110109985/PH/1

November 20, 2019

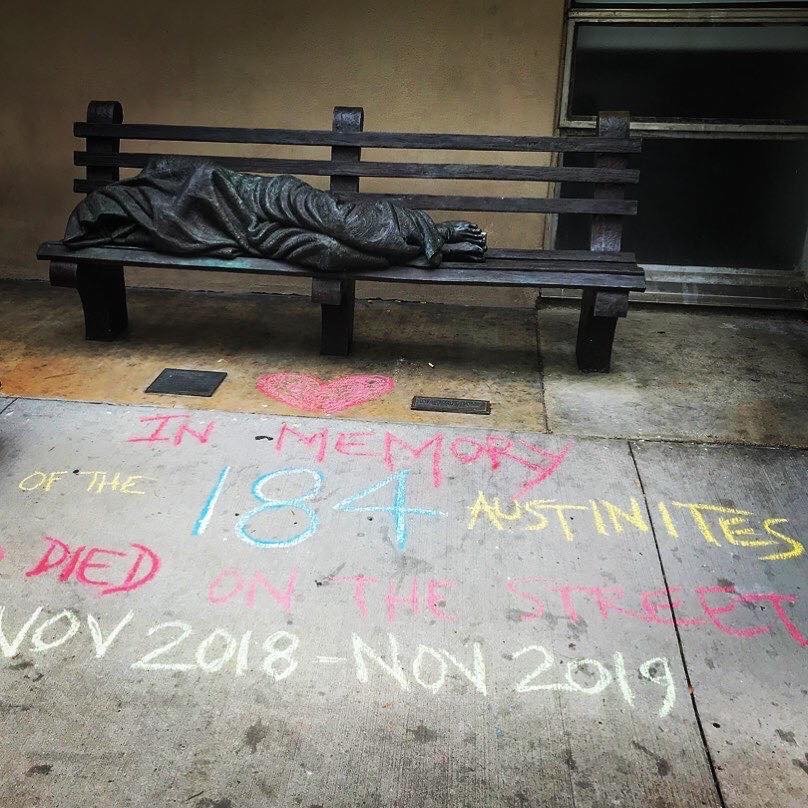

Austin American Statesman from 11/01/2019 early morning service – prayers for homelessness and a better way. https://www.statesman.com/photogallery/TX/20191101/PHOTOGALLERY/110109985/PH/1

November 3, 2019

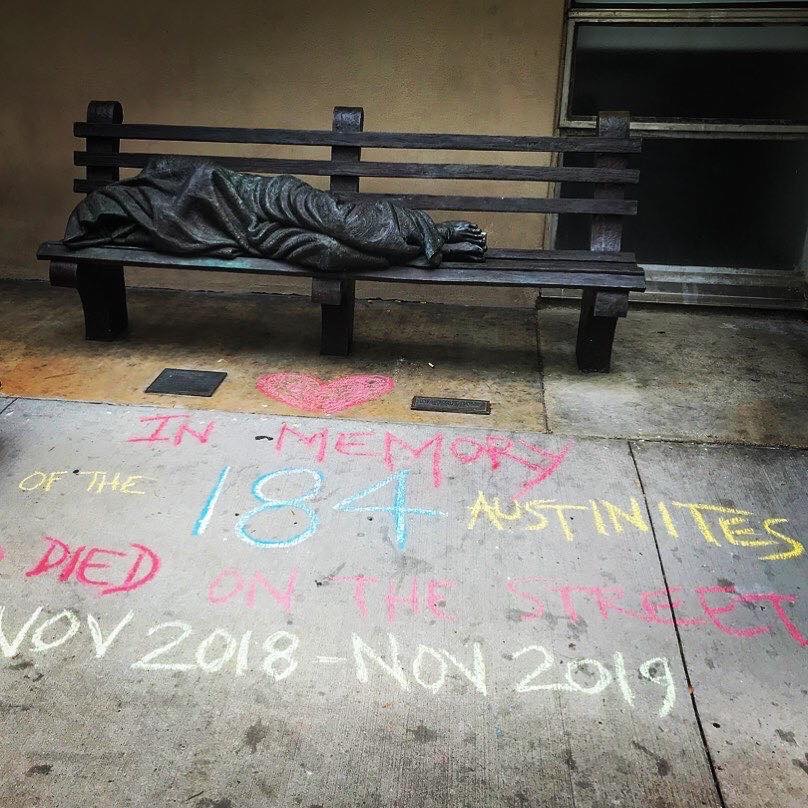

Austin American Statesman from Friday’s 11/01/2019 early morning service – prayers for homelessness and a better way. https://www.statesman.com/photogallery/TX/20191101/PHOTOGALLERY/110109985/PH/1

October 9, 2019

Stewardship Season

Our courageous giving changes the world!

Stewardship Season is here! Each year during this season, we renew our financial and time commitments to this special place. The Stewardship Team requests that members and other pledgers submit their annual pledges for 2020 starting on October 20, 2019. Annual pledges make up a significant portion of Central Presbyterian Church’s budget. Your courageous generosity and the generosity of our predecessors has allowed this congregation to thrive for 180 years. The Stewardship Team has mailed out brochures containing pledge cards, but you can also find the pledge card on CPC’s website. Thank you for your support of this special place.

Stay alert, stand firm in the faith, show courage, be strong. Let all that you do be done in love. 1 CORINTHIANS 16: 13-14.

September 19, 2019

I am not sure when the evangelical church hijacked Christianity and took it to a place Jesus never dreamed it would land — a place where people celebrate the prosperity Gospel, reject refugees, and claim their political candidate is ordained by God. But it is past time for the church to head in a new direction. I wonder if we can make that happen by proclaiming our love for a totally different Jesus. Could we silence the ferocious voice of conservative religion? Could we travel together to the place of love and hope on earth that Jesus imagined? I sure would like to try.

It is true. I love Jesus. But the Jesus I love looks nothing like the popular one running around our country spewing fear and hate. The Jesus I love is brown, not white. He didn’t grow up in the Bible Belt. He grew up in the Middle East. He never said a peep about sexual orientation, but he had a good plenty to say about love, forgiveness, and generosity. Jesus didn’t objectify women, he empowered them. He didn’t put children in cages, he blessed them. Jesus didn’t reject people because of their religious preference or nationality. He talked to them. He healed them. He loved them. That is the Jesus I love. That is the Jesus CPC proclaims.

May that Jesus inspire us with life and love and hope to share with the world.

Gratefully yours,

Pastor Katheryn

September 7, 2019

“Safe? Who said anything about safe? ‘Course God isn’t safe. But God is Good”

– Adapted from C.S Lewis, The Lion, the Witch and the Wardrobe

https://cpcaustin.org/ministries-fellowship/children-teens/

https://cpcaustin.org/ministries-fellowship/adult-sunday-morning-classes/

Courage starts with showing up and letting ourselves be seen” – Brene Brown

https://cpcaustin.org/ministries-fellowship/adult-fellowship-groups/

Our ministry teams work together to fulfill CPC’s mission to be “deliberately diverse and fully inclusive.” Even if you can’t commit to a monthly meeting, you can still participate. Please see the list below and prayerfully consider how you might contribute to our team work. We would be thrilled to welcome you!